Friday, January 28, 2011

Thursday, January 27, 2011

George Soros Lecture Series

Wednesday, January 26, 2011

Soros Sees U.K. Recession If Deficit Plan Implemented , By Simon Kennedy and Scott Hamilton

Billionaire investor George Soros, who reportedly made $1 billion selling the pound in 1992, said the U.K. government will have to rethink its budget deficit- cutting plan or risk pushing the economy back into recession.

“They will probably have the sense that they will have to modify it when the effects are felt,” Soros told reporters today at the World Economic Forum’s annual meeting in Davos, Switzerland. The plan cannot “possibly be implemented without pushing the economy into a recession.”

Britain’s economy unexpectedly shrank 0.5 percent in the final three months of 2010 as the coldest December in a century hampered services and retailing, data showed yesterday. That suggests the recovery faded even before Prime Minister David Cameron’s government implements the largest fiscal squeeze since World War II. Soros said the plan to tackle the record deficit is “unsustainable.”

How fast governments should be restoring fiscal order was a theme of the first day of the Davos conference. Chief executive officers and economists criticized President Barack Obama for not acting quickly enough to reduce the U.S.’s $1.2 trillion deficit even after yesterday revealing almost $500 billion in fresh savings measures.

‘More Action’

“We need a heck of a lot more action” in the U.S., said James Turley, chief executive of Ernst & Young LLP.

Cameron reacted to the first shock of his eight-month-old coalition by sticking with his vow to eliminate the deficit, which Soros acknowledged had been greeted well by investors.

“The worst thing you could do would be to ditch your plans on the basis of one quarter’s figures,” Cameron said in Parliament in London today. Justice Secretary Kenneth Clarke, a former chancellor of the exchequer, told BBC Television today that the U.K. faces a “difficult two or three years” until the economy returns to full productive capacity.

The U.K. strategy won backing from Angel Gurria, secretary general of the Organization for Economic Cooperation and Development, who told the BBC today that the government “should stay the course.”

Nouriel Roubini, the chairman of Roubini Global Economics LLC who predicted the recent financial crisis, said in Davos that the latest U.K. data “suggest the risk of a double-dip or long-term stagnation are not done forever.”

Speaking on the same panel, Martin Sorrell, CEO of advertising firm WPP Plc, nevertheless praised the U.K. for acting faster than the U.S. to cut its deficit. “At least they’re trying to deal with the issue,” Sorrell said.

Choppy

Bank of England Governor Mervyn King said yesterday the fourth-quarter data pointed to a “choppy” recovery, comments echoed by Cameron in Parliament today when he said growth is likely to be “choppy and difficult.”

The prime minister made the deficit, which grew to 11.1 percent of gross domestic product in the last fiscal year, his top priority after Standard & Poor’s threatened to lower the U.K.’s AAA credit rating in May 2009. S&P affirmed the rating after the government presented the fiscal plan in October.

Chancellor of the Exchequer George Osborne said that month that eliminating most of the deficit by 2015 was essential to prevent a loss of investor confidence. Both Osborne and Cameron are scheduled to attend the Davos conference.

Soros is chairman of Soros Fund Management LLC and his 1992 bet was that Britain would fail to keep its currency in a European exchange-rate system that pre-dated the euro. Other successful trades included a bet that the deutsche mark would rise after the collapse of the Berlin wall and a wager that Japanese stocks would start to tumble in 1989.

He also said today that European policy makers must address their two-speed economy or risk the euro collapsing, although he said that is unlikely to occur. He was speaking at the launch of a new economic research group that he and former Federal Reserve Chairman Paul Volcker will help sponsor.

Friday, January 21, 2011

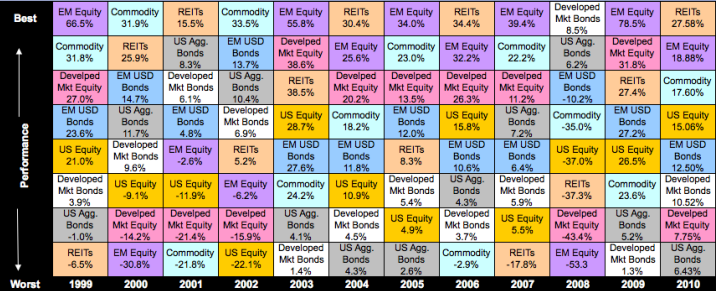

Sector Rotation for the past decade

Now let us compare compounded return for 1000 dollars invested in each of the asset class over the 1999-2010 time period :

Asset Class

Wednesday, January 19, 2011

Tuesday, January 18, 2011

Sunday, January 9, 2011

Saturday, January 8, 2011

Friday, January 7, 2011

Wednesday, January 5, 2011

Tuesday, January 4, 2011

Saturday, January 1, 2011

Understanding How to Invest for the long term .

Discounted Cash Flow Model = EPS , Dividend , Cashflows / ( Investors Expected Rate of Return - Expected Growth Rate of the Company )

If cashflow is used in the numerator , its advisable to look at the growth rate in Cashflow so that we are comparing apples to apples , and oranges to oranges , And the same goes for EPS , or Dividends .

Let us simplify and put the formula then finally : EPS / ( R- g)

A large base of loyal customers , and a price dominance within the industry .

Now let us do the calculation : 42/ (0.20 - 0.1471) = Rs. 793.95

Now using the FV = PV ( 1+R)^n ( Assuming R = 20 % )

For 30 Years : 188,464.92 / 237.38 ( for every Rupee )

For 40 Years : 1,166,925.14/ 1469.77 ( for every Rupee )